Concept Drawings and All Day Open House Scheduled for Magrath Swimming Pool

Walk in Open House July 9th from 9AM to 7PM at Town Hall

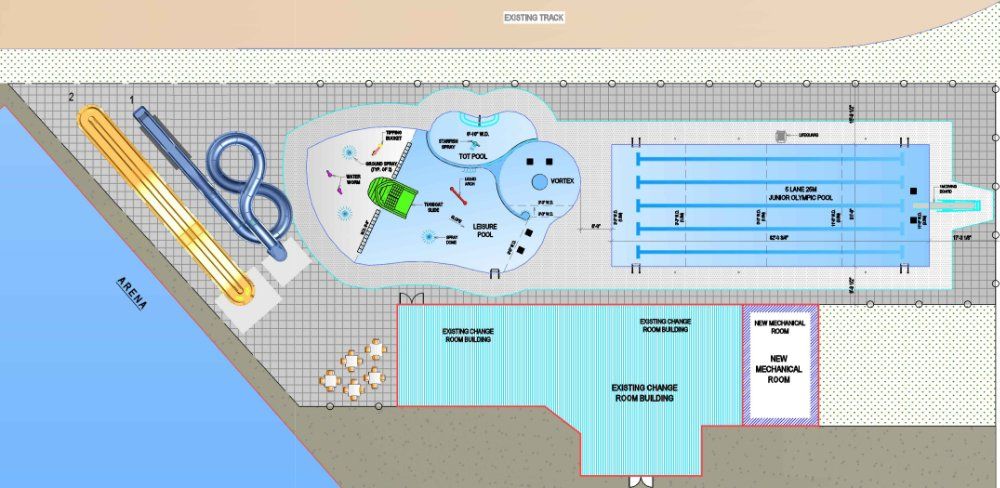

With the assistance from the Magrath Rec Committee in the RFP selection and review process The Town of Magrath is excited to release to residents a concept drawing of the new swimming pool. Now, with a prepared concept drawing, further community engagement is welcome and to facilitate that in a COVID friendly way The Town Hall will be hosting a walk-in all day open house on July 9th from 9:00AM to 7:00PM. Tow Residents are welcome to stop in and staff will be on hand to discuss the concept drawing, the pool's features, and the estimated construction schedule.

The project as shown has an estimated final cost of $1,800,000. Currently, the Town has $1,475,000 in committed funding. A community fundraising effort will be required to raise the final $325,000 to fully fund the project. Community members and businesses interested in donating can contact any member of Town Council or James Suffredine the Town's Chief Administrative Officer at 403-758-3212.

Project Scope:

New Leisure Pool

- Young Child friendly fiberglass slide

- Multiple water play-and-spray features

- Jet powered whirling vortex

- Partitioned 25CM depth toddler pool

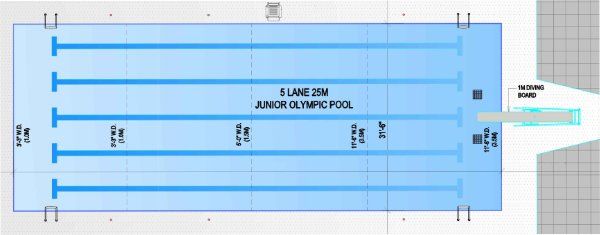

- 5 Lanes

- 3.5M deep-end with a 1M diving board

- Off center design facilitates usable space for lounge chairs and seating along the north side of the pool.

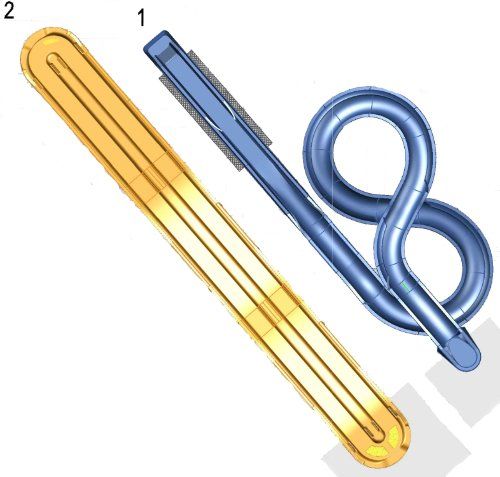

Water Slides

- Water Slide 1 - Twister slide with run out exit

- Water Slide 2 - Pro-racer double slide with run out exit

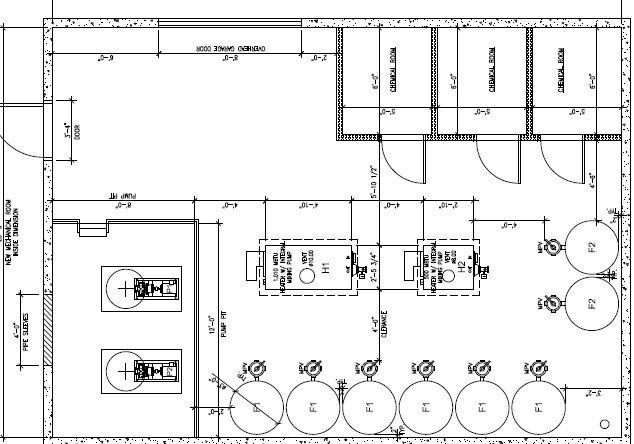

New mechanical room for pool filtration

- 2 hour water turn over in the leisure pool

- 4 hour water turn over in the Jr. Olympic Pool

- Tot pool equipped with isolated quick release drain for contamination events

- Separate chemical rooms designed for operator safety